is colorado a community property state for tax purposes

In contrast to community property common law property is considered to be the property of the spouse who acquires it during a marriage unless it is put in the names of both. The IRSs discussion of community and separate property does not recognize quasi-community property for federal tax purposes.

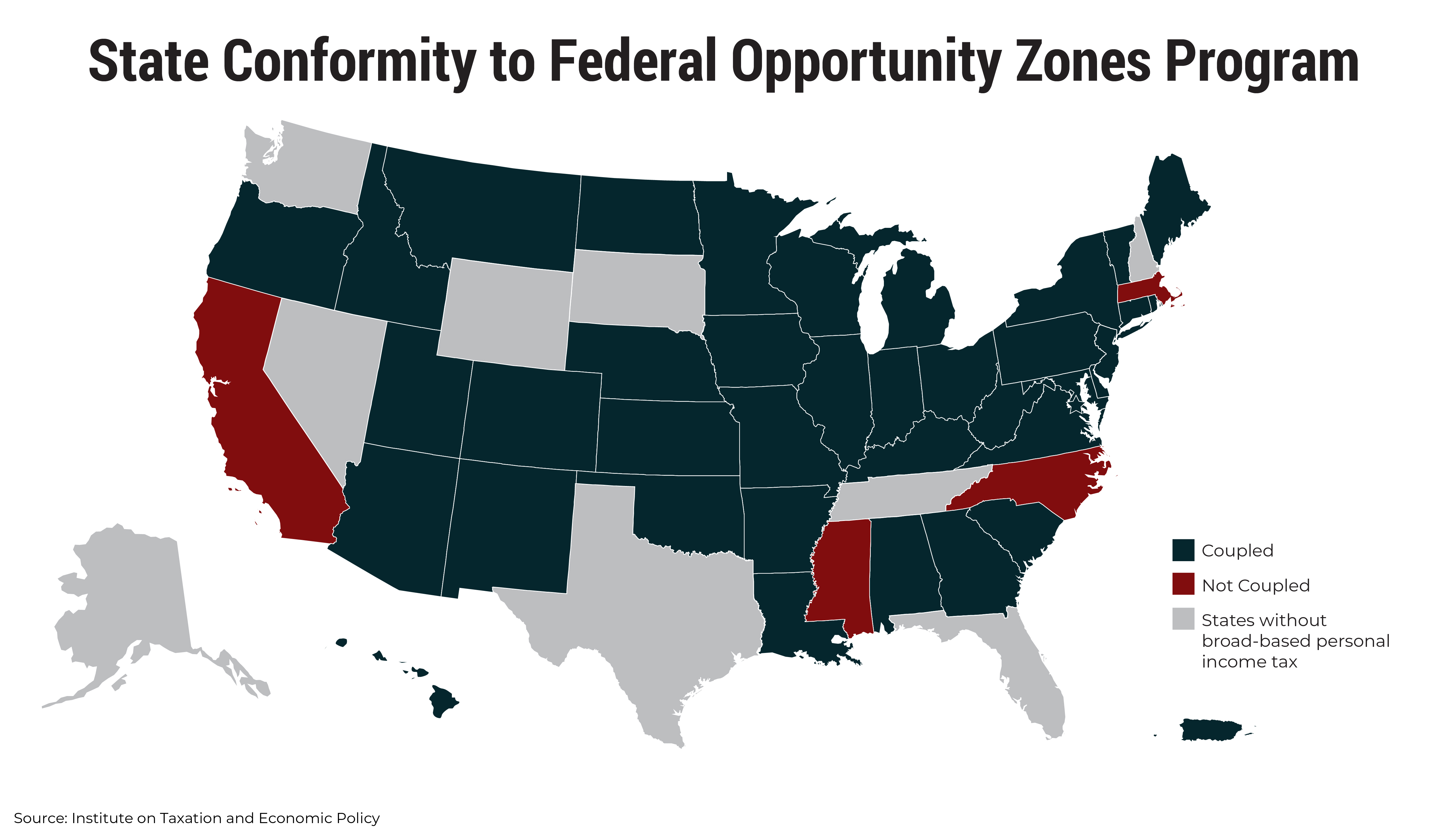

States Should Decouple From Costly Federal Opportunity Zones And Reject Look Alike Programs Itep

Nine states have community property laws that govern how married couples share ownership of their incomes and property.

. The reason for this is that it helps to eliminate confusion that once existed. If a couple moves from a community property state. In addition Alaska is an opt-in community.

That means marital property isnt automatically assumed to be. These states are Arizona California Idaho. In fact there are only 9 states that have adopted community property laws.

The State of Colorado distinguishes between property and property belonging to the conjugal estate both spouses and separated property belonging to one of the spouses. For example if you have a 90 basis in a property and sell it for 100 you will only pay tax on the 10 difference between your basis. Generally when an asset or debt is acquired after marriage it is generally considered part of the marital estate.

Colorado imposes a withholding requirement on corporations that do not maintain a permanent place of business in Colorado and non-resident individuals estates and trusts on. Colorado is not a community property state. Division of Property Taxation 1313 Sherman St Room 419 Denver CO 80203 Phone.

On your separate returns each of you must report 10000 of. Colorado is not a community property state. How Your States Community Property Laws Can Affect Your Tax Returns.

According to the IRS. Colorado real property is generally assessed for tax purposes on a two-year cycle which occurs every odd year. Married couples who live in community property states jointly own their marital property assets and.

Arizona California Idaho Louisiana Nevada New Mexico Texas Washington and Wisconsin are all community property states. Generally the laws of the state in which you are domiciled govern whether you have community property. The tax benefit of community property is that at the first spouses death ALL of it receives a new tax basis.

Community Property States vs. The Abstract of Assessment abstract is a compilation of all real and personal property located within the boundaries of each county. There are significant legal and financial ramifications to how property is categorized for the purposes of a divorce.

Colorado is an equitable distribution or common law state rather than a community property state. This eliminates all accrued but unrealized capital gains and losses. Colorado rental property owners must attach their federal return to their state return to file.

Colorado is an equitable distribution or common law state rather than a community property state. Is Colorado A Community Property State For Tax Purposes The. In community property states the assets of each spouse are considered assets of the marital unitThe assets of each partner in the relationship.

According to USA Today Colorado has the 7th lowest property tax rates in the country although that is a statewide average. Colorado Property Assessments. Community Property Option in DeedClaim Deed Interview.

Colorado is not a community property state in a divorce. Colorado is an equitable distribution state which means property will be divided by the court in a manner that is deemed fair to both parties but not necessarily equal if spouses cannot come to a resolution on their own. Under 39-5-123 CRS each county assessor is required.

For income tax purposes if spouses file separate returns each spouse is taxed on 50 of the total community property income regardless of which spouse acquired the income. Of Local Affairs 2013 Annual Report. Colorado does not currently impose a property tax for state purposes see Colorado Dept.

Under your state law earnings of a spouse living separately and apart from the other spouse continue as community property. What is the state property tax rate. The median-value home in Colorado has a.

Thinking About Moving These States Have The Lowest Property Taxes

States With Highest And Lowest Sales Tax Rates

Tax Burden By State 2022 State And Local Taxes Tax Foundation

States With No Estate Tax Or Inheritance Tax Plan Where You Die

State Taxation As It Applies To 1031 Exchanges

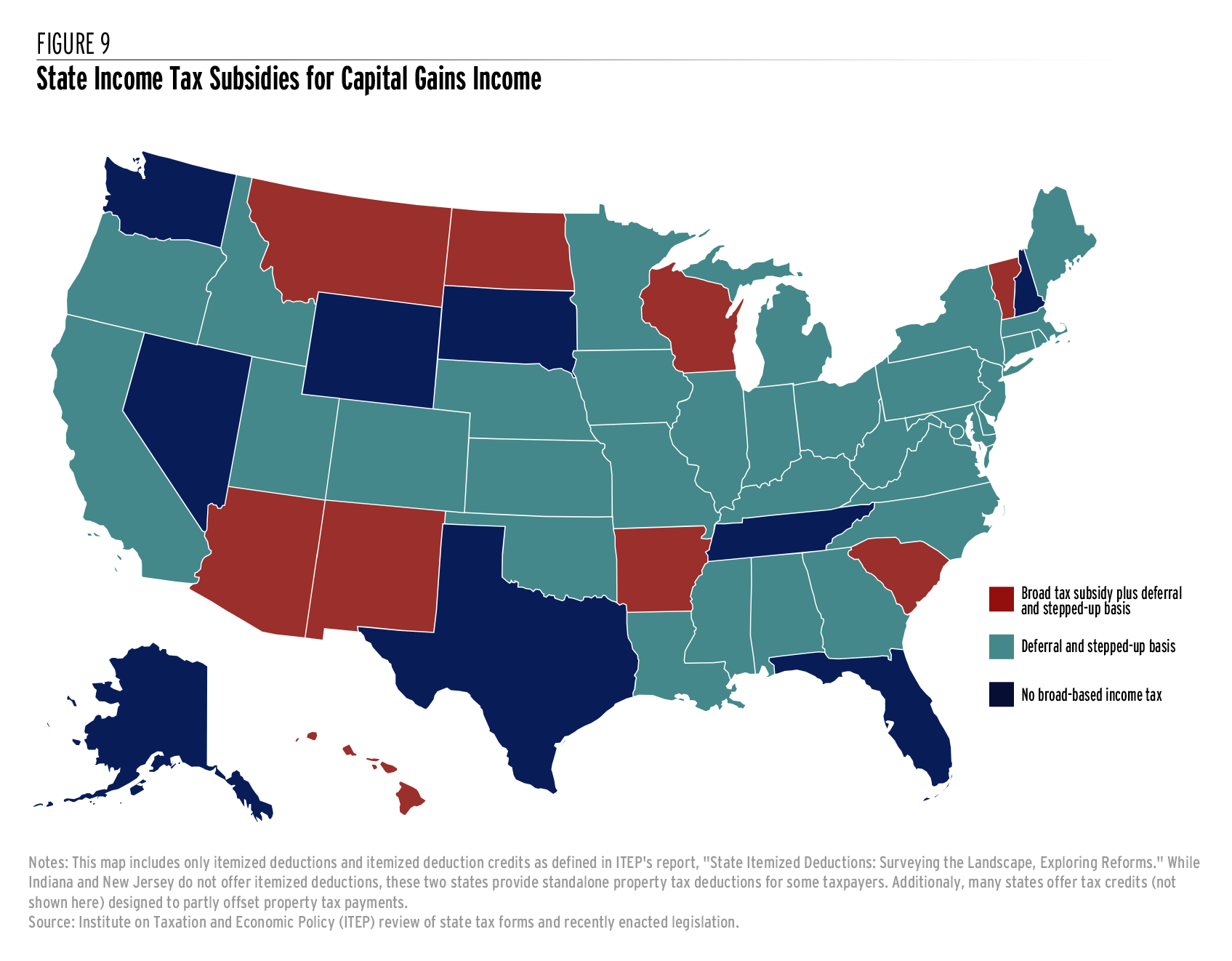

State Income Taxes And Racial Equity Narrowing Racial Income And Wealth Gaps With State Personal Income Taxes Itep

A Guide To The Best And Worst States To Retire In

States With No Estate Tax Or Inheritance Tax Plan Where You Die

States Without Sales Tax Article

Several Proposed Us States Throughout History Maps Interestingmaps Interesting U S States Illustrated Map Map

The Top 5 States To Form An Investment Real Estate Llc

Iowa Sales Tax Small Business Guide Truic

The States Where People Are Burdened With The Highest Taxes Zippia

Community Property States List Vs Common Law Taxes Definition

How Do State And Local Sales Taxes Work Tax Policy Center

State Taxation As It Applies To 1031 Exchanges

5 Income Tax Tips For Notaries And Signing Agents Tax Deductions Irs Taxes Tax Questions

States With The Highest And Lowest Property Taxes Property Tax States Tax

:max_bytes(150000):strip_icc()/states-without-an-income-tax-3193345-01-41573651b8a540cd84509ffb3052580c.png)